Mortgage Broker Near Me Can Be Fun For Anyone

Wiki Article

Not known Factual Statements About Mortgage Broker Near Me

Table of ContentsHow Scarborough Mortgage Broker can Save You Time, Stress, and Money.Some Ideas on Mortgage Broker Near Me You Should Know3 Simple Techniques For Mortgage Broker ScarboroughThe smart Trick of Mortgage Broker Scarborough That Nobody is DiscussingSome Ideas on Mortgage Broker In Scarborough You Should KnowSome Ideas on Scarborough Mortgage Broker You Need To KnowHow Scarborough Mortgage Broker can Save You Time, Stress, and Money.Mortgage Broker Fundamentals Explained

You're a little nervous when you first arrive at the home loan broker's office. You need a home lending Yet what you really desire is the home."What do I do currently?" you ask. This initial conference is essentially an 'information celebration' objective. The home loan broker's work is to comprehend what you're trying to achieve, exercise whether you are prepared to enter every now and then match a lender to that. Prior to talking about lenders, they require to gather all the details from you that a bank will certainly require.

The Ultimate Guide To Mortgage Broker Scarborough

A significant modification to the sector happening this year is that Home mortgage Brokers will certainly have to follow "Ideal Interests Obligation" which indicates that legitimately they have to place the client. Interestingly, the banks do not have to comply with this new regulation which will benefit those clients using a Mortgage Broker even much more.It's a mortgage broker's job to aid obtain you prepared. Maybe that your cost savings aren't fairly yet where they need to be, or maybe that your revenue is a little bit doubtful or you've been freelance and the banks require more time to examine your circumstance. If you're not yet all set, a mortgage broker is there to equip you with the expertise and also recommendations on exactly how to enhance your position for a lending.

Scarborough Mortgage Broker Fundamentals Explained

Home loan brokers are storytellers. Their job is to repaint you in the light that provides you the biggest opportunity of being authorized for a funding. The loan provider has accepted your financing.The house is your own. Created in collaboration with Madeleine Mc, Donald.

Mortgage Broker In Scarborough - Questions

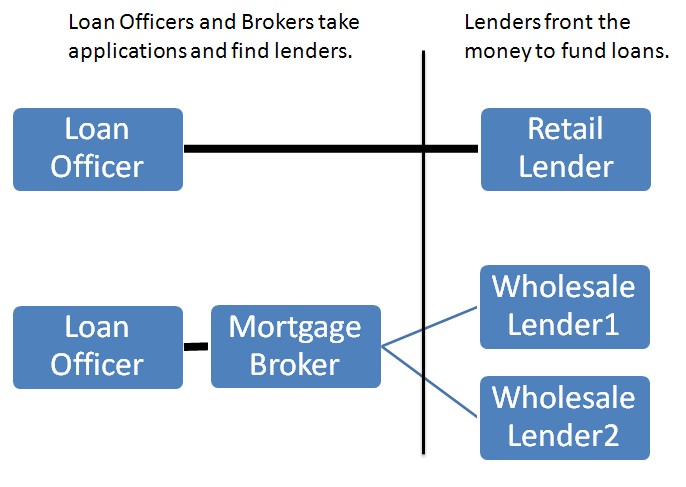

They do this by comparing home mortgage products supplied by a selection of loan providers. A mortgage broker serves as the quarterback for your funding, passing the sphere between you, the customer, and the lending institution. To be clear, mortgage brokers do a lot more than assist you obtain a basic home loan on your home.

When you most likely to the bank, the bank can just offer you the product or services it has available. A financial institution isn't most likely to inform you to decrease the road to its rival that supplies a mortgage product much better suited to your requirements. Unlike a financial institution, a mortgage broker usually has connections with (sometimes some lenders that do not straight deal with the public), making his possibilities that a lot better of discovering a lending institution with the most effective mortgage for you.

5 Easy Facts About Mortgage Broker Scarborough Shown

If you have actually already made a deal on a property and it's been accepted, your broker will certainly submit your application as a live offer. As soon as the broker has a home mortgage dedication back from the lender, he'll look at any type of conditions that require to be satisfied (an assessment, proof of revenue, proof of deposit, and so on). mortgage broker Scarborough.

Some Known Details About Scarborough Mortgage Broker

As soon as all the lender problems have actually been fulfilled, your broker should ensure lawful instructions are sent to your lawyer. Your broker should remain to inspect in on you throughout the process to make sure whatever goes smoothly. This, essentially, is exactly how a mortgage application works. Why use a home mortgage broker You may be wondering why you should use a home mortgage broker.Your broker must be well-versed in the mortgage products of all these lending institutions. This implies you're more likely to discover the finest home loan product that suits your needs.

The Ultimate Guide To Mortgage Broker Near Me

Be sure to ask your broker the number of lenders he takes care of, as some brokers have access to more lending institutions than others and also may do a higher volume of company than others, which implies you'll likely obtain a much better rate. This was an overview of dealing with a mortgage broker (mortgage broker near me).

More About Mortgage Broker Near Me

85%Promoted Rate (p. a.)2. 21%Comparison Rate (p. a.) Base criteria of: a $400,000 financing amount, variable, dealt with, principal as well as rate of interest (P&I) house lendings with an LVR (loan-to-value) ratio of at least 80%. The 'Contrast House Loans' table permits for calculations to made on variables as picked and also input by the customer.The option to using a home mortgage broker is for people to do it themselves, which is often referred to as going 'direct'. A 2018 ASIC study of customers who had taken out a car loan in the previous 12 months reported that 56% went direct with a loan provider while 44% went through a mortgage broker.

Report this wiki page